Follow the steps below to create a 1099 or 5498 batch, run necessary checks, and select the appropriate fulfillment options.

Step 1: Create a New Batch

Click + Create New Batch in the upper-left corner of the Batch screen.

Enter a Batch Name of your choice and select Create New Batch.

- This name is for your records only; the IRS does not see your naming conventions.

For corrective batches be sure to select the Corrective batch?* checkbox in the right-hand corner. Refer to 1099 Corrections for additional information on corrective batches.

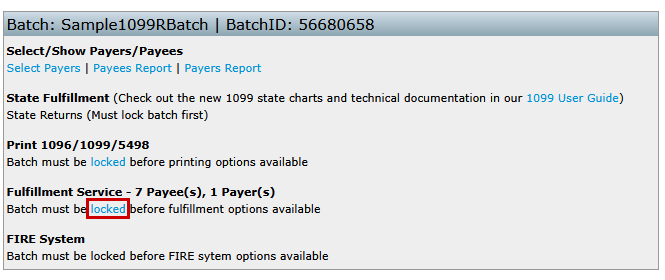

You will be redirected to the individual batch screen to select payers and payees.

Step 2: Select Payers and Payees

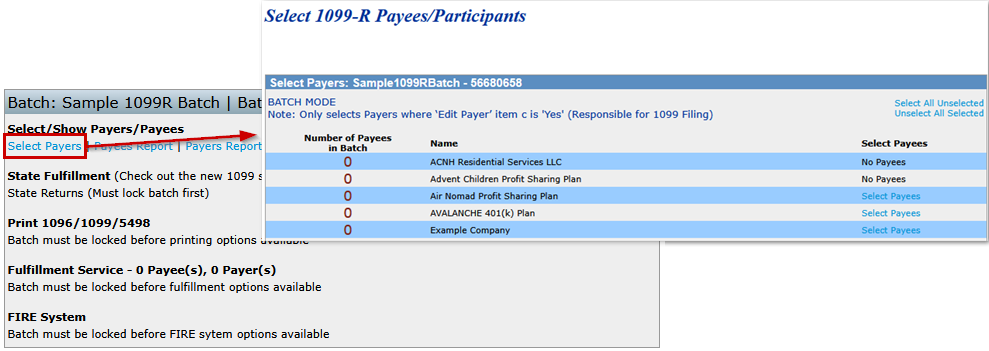

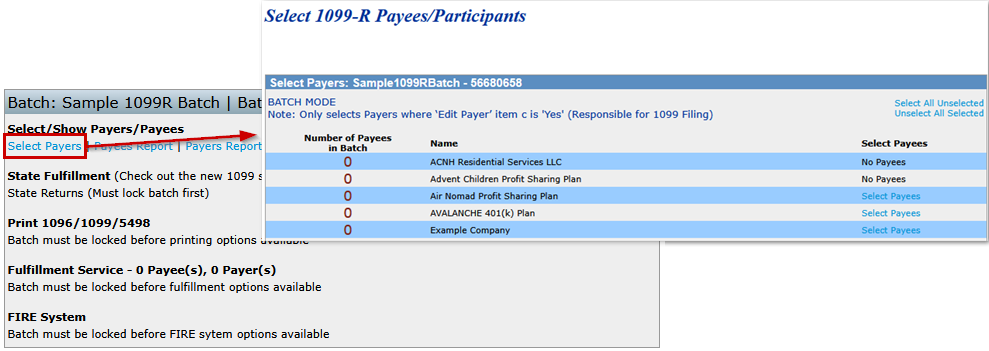

Click Select Payers in the upper-left corner of the batch screen.

A window will display all available payers for your account. This window provides the following options for selecting which payers/payees to add to (or remove from) the batch:

- Select All Unselected: Adds all available payers and payees to the batch at once (only those not already in a batch).

- Unselect All Selected: Removes all payers/payees from the batch.

- Select Payees: Allows individual selection of payers and payees. If payees exist, a blue Select Payees link appears next to the payer name.

When manually selecting via Select Payees, a screen opens where you can choose all or some payees for that plan/payer. Click Update to save and close.

The number of selected payees will appear on the left side of the Select 1099-R Payees/Participants page.

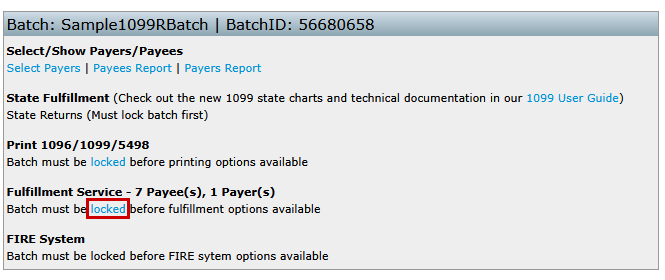

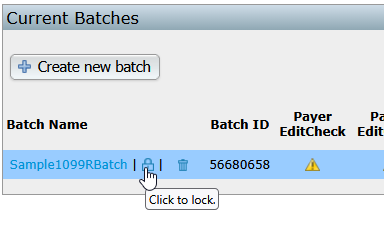

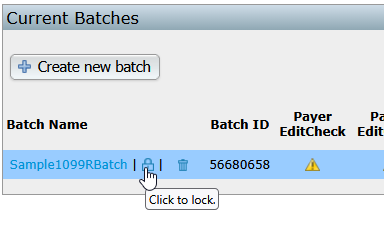

Step 3: Run Edit Checks and Lock the Batch

Important: Batches must be locked before fulfillment options are available.

To lock a batch:

- Click the Locked link under the Fulfillment Service heading.

- OR click the lock icon next to the batch name on the Show Batches page.

Before locking:

All included payers and payees must pass edit checks. This option automatically populates when the Locked link/icon is selected.- If edit checks have not been run, click Run Edit Checks.

- Once all checks pass (denoted by the Ok links), the option to lock the batch will be enabled and a warning: > “Are you sure you want to lock this batch? Once locked, participant information cannot be changed.”

Step 4: Select Fulfillment Options

Once the batch is locked, the following options become available:- Print 1096/1099/5498: Generate PDF files or batch data for printing.

- Fulfillment Services: Authorize ftwilliam.com to e-file the batch and/or send paper copies to payees for a fee.

See ftwilliam Fulfillment Services for details on fulfillment options.- Federal E-file

- Print and Mail Services

- State E-file

NOTE: State filings require separate edit checks and locking before enabling this option. See State Fulfillment Services for more details.

- FIRE File Download (if applicable): Available for accounts with a TCC entered in the profile. (See Preparing a .txt file for FIRE for more details.)

Depending upon the state entered in the applicable payee fields on the draft 1099, additional information may be required for fulfillment and/or fulfillment may not be an option. Click on "State Returns" within a batch to edit the state data required. The ftwilliam.com state fulfillment consists only of e-filing (see more details Here). ftwilliam.com does not send state paper statements nor does the system handle state corrections.

After clicking on 'State Returns', the user will be directed to the "State Returns" screen. On this screen, users will see a clickable link for each Payer(s) within the batch. The user will click on one Payer at a time to be directed to the "Select State" screen where the user will click on the state links that have reconciliation forms requesting more data.

In order to lock a batch for submission, all of the included state reconciliation forms must pass edit checks.

If the user wishes to use fulfillment for both state and federal filings, both the federal and state returns must be locked.

Several fulfillment options are available through the ftwilliam 1099 batching system. Each option determines which parties receive the forms and how the filing is handled.

Note: There is a fee to use this service, please see the 1099 Fulfillment Pricing Sheet for details.

Available Fulfillment Options

- Federal/State/Payee Fulfillment

Sends electronic forms to the IRS, applicable state agencies, and paper copies to payees. When selected, no other fulfillment options can be combined. - Federal/State Fulfillment

Sends electronic forms to the IRS and applicable state agencies. When selected, no other fulfillment options can be combined. - State Fulfillment

Sends electronic forms and reconciliation data to applicable state agencies. This service does not send the state(s) paper statements nor does the system handle state corrections. - Federal/Payee Fulfillment

Sends forms to the IRS and payees. When selected, no other fulfillment options can be combined. - Federal Only

Sends forms only to the IRS. The Payee Only option may also be selected as an additional batch. - Payee Only

Sends forms only to payees. The Federal Only option may also be selected as an additional batch.

Important Notices Before Proceeding

When a fulfillment link is selected, the user will see a warning similar to the following:

Once you click on this link your account will be charged $XX.XX (plus applicable sales & use tax) and we will immediately begin fulfilling your request. As a result ftwilliam.com/CCH INCORPORATED will incur substantial costs for postage and handling.THEREFORE, THE CHARGES TO YOUR ACCOUNT ARE FINAL AND NO CREDITS OR REFUNDS CAN BE GIVEN. FAILURE TO PAY THE ABOVE CHARGES MAY RESULT IN INACTIVATION OF YOUR ACCOUNT. BY CLICKING ON THE LINK BELOW YOU HEREBY AGREE TO THE FOREGOING.

Please be aware that by clicking the link you authorize ftwilliam.com/CCH INCORPORATED to electronically file the Form 1099 on behalf of the payer (or other person required to file). ftwilliam.com/CCH INCORPORATED, as an authorized agent, does not relieve the payer of the responsibility for filing correct, complete and timely information returns. Further, it will not relieve the payer of any penalties for not complying with those requirements.

ftwilliam.com/CCH INCORPORATED grants no implied warranties, including without limitation, warranties of merchantability or of fitness for a particular purpose. ftwilliam.com/CCH INCORPORATED is not liable for any lost profits or any claim against the filer by any party. In no event is ftwilliam.com/CCH INCORPORATED liable for consequential damages, even if ftwilliam.com/CCH INCORPORATED had been advised of the possibility of such damages.

The filer is advised to retain a copy of Form 1099 and any supporting material. A copy of Form 1099 is available from ftwilliam.com.

IMPORTANT NOTICE: Once you submit your returns, they are processed through an automated system. We cannot make any changes to your forms once they are submitted.

Users selecting corrective or state 1099 fulfillment also agree to the terms here.

Next Steps

- To cancel, select Return Without Fulfillment.

- To proceed, select Fulfill [fulfillment type] Information for [batch name].

Once a batch has been sent for fulfillment, users can view the completion status from the "Show Batches" screen. See below for information related to each heading on that page:

- Payer Completion Date

- This column will update to "Pending" when the Payer Only option is selected for fulfillment.

- During busy seasons, the batch will update from pending to "In Process" within 1-2 business days.

- A completion date will be entered once all Payers within the batch have been printed and mailed. This typically takes 4-5 business days.

- Payee Completion Date

- This column will update to "Pending" when any one of the Payee options has been selected for fulfillment.

- During busy seasons, the batch will update from pending to "In Process" within 1-2 business days.

- A completion date will be entered once all Payees within the batch have been printed and mailed. This typically takes 4-5 business days.

- E-File Completion Date

- This column will update to "Pending" when any one of the Federal/State options has been selected for fulfillment.

- During busy seasons, the batch will update from pending to "In Process" within 1-2 business days.

- A completion date will be entered once all Federal/State data within the batch has been given a "GOOD" status from the IRS. This typically takes 4-5 business days.

- Quick Reference - What do the colors mean?

- Pending: We have received your request for fulfillment.

- In process: Your batch has been submitted to the IRS. Note: It is normal for a batch to still be 'In process' after the filing deadline while the IRS examines all submissions.

- Rejected: This is a rare occurrence and you will need to contact support@ftwilliam.com to check on your batch status.

- Completed: We have received confirmation from the IRS that all submissions are 'GOOD'.

- Completed: There are rare occasions when a filing marked for Federal and State fulfillment receives a rejection from the state. In this case the batch has completed and has made its way to both the IRS and the individual state, but the state has found an issue that needs to be resolved. Contact support@ftwilliam.com to gain additional details.

Users can download files from ftwilliam.com for upload into the FIRE system. Note that for 8955-SSA forms each filing is uploaded separately - that is not the case for 1099s as user can upload the .txt files in a batch.

Before users are able to download .txt files, users must obtain a Transmitter Control Code (TCC) from the IRS to file on the FIRE system specifically for the 1099s. This is a 5-digit code and users will need to complete an IR Application to apply for one.

If users have a TCC code, or once users receive a TCC Code, the Master Admin user for the account will be able to update the account by navigating to the WK Logo > Administrative Tasks > Account Profile to update the "1099 TCC Code Information" box at the bottom of the screen. Be sure to click "Update" to save changes.

After the TCC Code is on file, users will need to prepare a batch and lock the batch. Once the batch is locked, users should click on the batch name in order to view the "Download Data for FIRE system" found below the "FIRE System" section. Clicking on the "Download Data for FIRE system" link will produce a text file (.txt) that users should save to the user's hard drive. Users will take the file(s) to the IRS website to upload to complete the Federal e-filing.

Review FIRE Data File: Users can re-upload the .txt file downloaded to test and confirm the data downloaded.