Uploading Payee data in bulk is an efficient way to manage large numbers of Payees. This process is completed through the "Upload/Download Center" and allows for batch uploads, saving time compared to manual entry. There are two different options to upload this information.

Follow the steps for Option 1 (Uploading a Spreadsheet) or Option 2 (Uploading Vendor XML file) to complete the upload for Payees.

Option 1

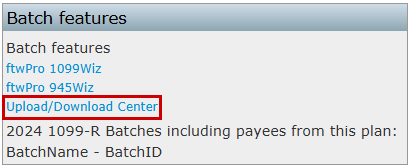

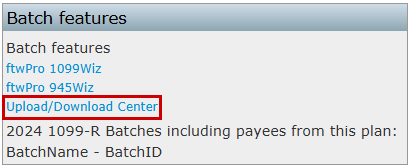

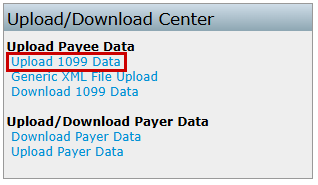

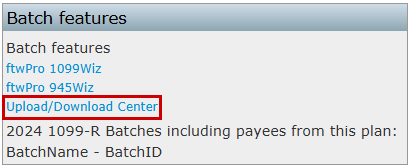

- Navigate to the Upload/Download Center located within the "Batch Features" section on the "Form 1099 - Year" screen.

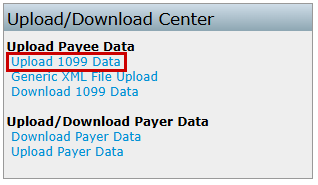

- From the available options under Upload Payee Data select Upload 1099 Data

- Select an upload method:

- There are two methods for uploading data as well as applicable sample templates:

- Payer TIN: Use this method to upload Payees based on the Payer's Taxpayer Identification Number (TIN). This is the traditional approach for most users.

- For Payer TIN, download "Sample_PayerTIN_1099R_2024.csv."

- Company EIN/Plan Number: Use this method to upload Payees when multiple plans share the same TIN. This option ensures data accuracy for individual plans.

- For EIN/Plan Number, download "Sample_EINPN_1099R_2024.csv."

- Payer TIN: Use this method to upload Payees based on the Payer's Taxpayer Identification Number (TIN). This is the traditional approach for most users.

- There are two methods for uploading data as well as applicable sample templates:

- The downloaded file serves as a template for entering Payee information:

- Enter Payee Data: Populate the spreadsheet with all necessary data for one or multiple plans, grouped by TIN or EIN/Plan Number (PN).

- Follow the Format: The "Field Names" schema file provides details on how to format the data correctly, including column headers and data requirements.

- IND Columns: Use 0 to leave checkboxes unchecked and 1 to check them.

- Additional Distributions: Up to 12 additional distributions can be included for a Payee using the columns PayDate1–PayDate12, PayAmount1–PayAmount12, and PartWHAmount1–PartWHAmount12.

- To see a sample upload file for a batch upload of all payees grouped together by the payer's TINs, click here.

Note:

- Do not delete the column headers.

- If current payees have been added, the user will be able to override existing payees. If the user does not wish to override existing payees, the user will need to un-check the box before performing the upload.

- Upload the Completed File:

- Return to the "Upload 1099 Data" section in the Upload Center.

- Browse for and select the prepared .csv file.

- Click "Submit" to upload the file.

- Review the Upload Results:

- After submission:

- The results will display the total number of Payees successfully added and highlight any "Bad Data" that requires attention.

- Verify the uploaded data in the "Edit Payees" dropdown.

- After submission:

Option 2

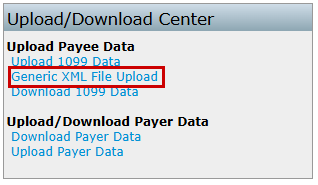

The Generic XML File Upload is primarily used to import data downloaded from another vendor's Software. If you are having trouble with the upload, please contact support@ftwilliam.com.

- Navigate to the "Upload/Download Center" located within the "Batch Features" section on the "Form 1099 - Year" screen.

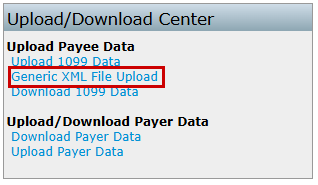

- Under the Upload Payee Data select Generic XML File Upload.

- Upload the XML File:

- Click Browse and locate the saved .xml file on the computer.

- Click Submit to upload the file.

Note: The upload will replace any data previously uploaded or manually entered.

- Review the Upload Results:

- Note that "Upload Results" will not provide detailed feedback.

- Proceed to run edit checks to ensure the uploaded data is accurate.

- Return to the 1099 Module:

- Use the breadcrumb trail to navigate back to "1099-X Year."

- After uploading, verify that all Payees appear in the "Edit Payees" dropdown.

Note: Regardless of method after uploading once uploaded, running edit checks is essential to ensure the accuracy of the uploaded data (see Edit Checking for additional information).