To complete an 8955 -SSA, look for the "8955 - SSA" box in the upper-right hand corner of the "Form 5500 - Year" screen (shown below). Along the top of the box are options for IRS FAQs for 8955 - SSA, "Batches/Fulfillment" (allows you to upload data for multiple plans) and "Upload." In the middle of the box are options to help you complete the 8955 - SSA for the particular plan and filing year and along the bottom of the box are options to complete the statement data. |

How to Start Top

There are three ways to add the Page 1 data:

- Click on "Add 8955 - SSA" within the "8955 - SSA" box.

- Click on "Upload" within the "8955 - SSA" box. See Uploading Data to 8955 - SSA - Single Plan for more details.

- Click on "Batches/Fulfillment" within the "8955 - SSA" box. See Uploading Data to 8955 - SSA - Batch (for multiple plans) for more details.

If you click on "Add 8955-SSA" most of the basic plan information should populate Page 1 from the Form 5500/SF (or the basic company information on the "Select Plan" screen if no Form 5500/SF is added). While in the draft form, you will be able to add page 2s by clicking on "p2" (either from the "Form 8955 - SSA" box or along the left-hand side of the page when the form is open). Page 2 will contain the participant data and there is no limit on the number of Page 2s a form may have. To add multiple Page 2s, click on "p2" again.

The description of each new page will be "New." You may change the description at the top of the schedule by clicking on the schedule under the "DRAFT - EDIT" heading in the "Form 8955-SSA" box. You will see the text "Enter a 5 character description New" at the top of the schedule/page. Hover your cursor over the word "New" and you will find it is a data entry field that may be modified. You may use any 5 character description to assist you in differentiating the multiple pages of a schedule. You may manually type in the participants on page 2 or you may upload the data by using a .csv file (see 8955- SSA Participant Upload). After you are done completing Page 1 and/or Page 2, click on "Run Edit Checks" on the left-hand side of the screen. Double-click on any field that may highlight in yellow to see the specific edit check. Clicking on the "???" or "Not-OK" status will also run the edit checks for you.

Note: You must pass all edit checks in order to e-file via IRS FIRE and/or ftwilliam.com's fulfillment service.

After the 8955 data has been entered, the data verified and edit checks have been run, the filing may be added to a batch.

Access the Batch Screen:

- From within the 8955-SSA window of the 5500 module, click on the Batches/Fulfillment hyperlink.

Create a New Batch:

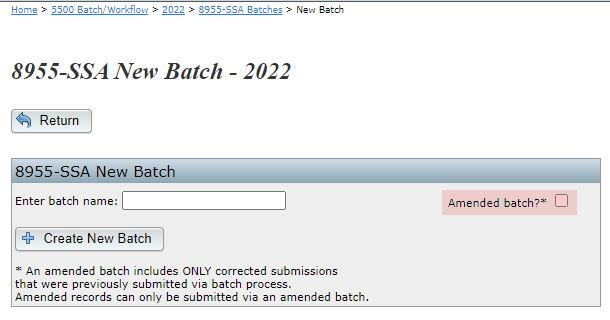

- From the Batches screen, click the Create New Batch button in the upper left corner.

- Enter a batch name for sorting and reference purposes, then click Create New Batch.

Note: The Amended Batch checkbox, when selected will only allow those filings with Part I Line B of Form 8955-SSA marked as an amended to be added to the batch. If this is an original filing please do not check this box.

Adding Plans to the batch:

- In the new batch, click the Select Plans hyperlink. This will show all plans in the company code with an 8955-SSA present and not yet included in another batch.

- Select the plans to add to the batch, then click Update (above or below the grid). Users may also choose to Select All or Unselect All in the upper right hand corner to quickly add all plans to the batch or remove the plans from the batch.

- After adding the plans, click the batch name link at the top of the breadcrumbs list.

- Once the plans are added users are redirected to the Batch screen that provides printing and fulfillment options.

- In the upper right, the number of plans and participants in the batch will be displayed.

- Below that is the Batch Lock status. The batch may only be locked if passing edit checks indicated by the green edit check icon beside the Batch Edit Check Status.

- A batch must be locked in order to e-file.

Note: The Statement Edit Checks do not need to be run or locked for e-filing the 8955-SSAs. ftwilliam.com does not offer a print and mail service. The statement batching feature checks for missing data and generates PDF files for printing outside the software. All plans in the batch will be compiled into a single file for each report type: Form 8955-SSAs, participant statements, and client letters (in .rtf or .pdf format).

Lock and E-file

- Click the padlock next to Batch Lock Status to lock the batch and enable fulfillment options.

- Once locked, click FIRE E-file:

- Clicking FIRE E-file does not automatically submit the order. A confirmation popup will appear, showing the user agreement and fees associated with the filing. By selecting Submit, the firm agrees to the terms provided, and the batch will be placed in a Pending status. A paper invoice from CCH Inc. will be sent in the first business week of the following month.

IMPORTANT NOTICE: Once you submit your returns, they are processed through an automated system. We cannot make any changes to your forms once they are submitted.

- If your account has its own TCC, and the details are entered in the Account Profile, the Download FIRE Files option will show either a TXT hyperlink (for one plan) or a ZIP hyperlink (for multiple plans). Clicking this will download a file to be saved and imported into the IRS FIRE site. The ZIP file contains individual .txt files for each plan; these must be uploaded separately to the FIRE site, as there is no batch upload option for Form 8955-SSA.

Note: To obtain a TCC for Form 8955-SSA, the IRS requires completing an online IR Application. Once assigned, the Master User for the ftwilliam.com account can enter the 8955-SSA TCC in the Edit Company Profile section under the Admin Menu. Enter the TCC, Contact Name, EIN, and State, then click Update at the bottom of the screen.

8955- SSA Page 1 Upload Top

|

8955 - SSA Participant Upload Top

|

When you are on the "8955 - SSA Participant Upload" screen, save the sample .csv file to your hard drive. Once you have your data entered and saved to the .csv file, browse for the saved file and click "Submit."

|

The following guide will walk through how to batch import 8955 forms to multiple plans.

Please Note: to use this feature plans must already exist in the software.

Step 1: Create a New 8955-SSA Batch

- From the Batches screen, click the Create New Batch button in the upper left corner.

- Enter a batch name for sorting and reference purposes, then click Create New Batch.

Note: The Amended Batch checkbox, when selected will only allow those filings with Part I Line B of Form 8955-SSA marked as an amended to be added to the batch. If this is an original filing, please do not check this box. Original and amended filings may not be submitted in the same batch.

Step 2: Accessing the Upload Features

- Select the Upload Menu hyperlink

- From here, select the Page 1 CSV upload option.

- The Participant CSV Upload is unavailable until a Form 8955-SSA is added to the plan.

Step 3: Upload Page 1 Data

- Users can download a sample file or all existing page 1 data in the software or download the starter file by either EIN/PN or FTW supplied IDs

Once the template is completed:

- Select the .CSV file for upload.

- Specify the number of rows to ignore before the header row (default is “0” if no rows exist above the header).

- Click Submit to complete the upload.

- After completing Page 1, click Return at the bottom left of the screen.

Note: Ensure the .csv file includes the unedited column headers when uploading. A schema file is available for download to provide detailed formatting instructions.

Step 4: Upload Participant Data (page 2)

- Once Page 1 has been added, the link to upload page 2 is enabled.

- Select the Participant CSV Upload link.

- Download a sample template or existing data for the plan if needed.

- Once the Participant data has been completed:

- Select the CSV format radio dial, either using the EIN/PN or the ftw supplied IDs.

- Select the CSV file for upload.

- Specify the number of rows to ignore before the header row (default is “0” if no rows exist above the header).

- Click Submit to complete the upload.

- After completing Page 2, click Return at the bottom left of the screen.

Step 5: Verify Data

- Once the Plans in Batch and Participants in Batch counts will populate in the upper right-hand corner.

- Edit Checks may be run in batch by selecting the yellow triangle Icon.

This guide explains the features and settings available within a batch. Before proceeding, see How to Create and Submit an 8955-SSA Batch for batch creation instructions.

To use batch features:

- Add plans to the batch using Select Plans or Upload Menu under Batch Setup (explained in more detail below).

- Once plans are added, batch options become enabled.

Batch Setup

- Select Plans: Add or remove individual plans with an active 8955 for the filing year. (This will update to View Plans once the batch is locked.)

- Upload Menu: Upload bulk 8955-SSA data for pages 1 and 2, then add completed forms to the batch. See Uploading Data to 8955-SSA - Batch (for multiple plans) for step by step instructions on using this feature.

- Cover Letter (optional): This link enables users to create a cover sheet that will be printed with the8955-SSA in the Printing section of the batch options. The following are the available options for Cover Sheets:

- None: The print features will not include a cover sheet

- Company Default: Uses the default template from Global Email Settings. (Global Email Settings>5500 Module>8955-SSA Cover Letter)

- Plan Specific: Uses a custom template for each plan (if available). (Located under the Draft-Edit section of the 8955-SSA window after the last listing of Page 2.) If a custom Plan Specific template has not been created, the Company Default letter will be used in its place.

- Batch Specific: Creates a customized letter for this batch only. The Company Default or Plan Specific cover letters will not be impacted by batch level changes.

Batch Summary Section

Located in the top-right of the batch window, this section displays:- Plans in Batch: Total plans added to this specific batch.

- Participants in Batch: Total participants across all selected plans in the batch.

- Batch Edit Check Status: Indicates if the plans in the batch are passing the required checks to be e-filed with the IRS.

- For the batch to be locked and fulfillment options enabled, every plan must pass edit checks.

- Selecting the Icon next to the status will run edit checks from within the batch. (Edit checks may also be run from the Current 8955-SSA Batches that lists all batches for the year.)

![]() A status code of a green check indicates that the edit checking was successfully completed, and no errors or warnings were detected.

A status code of a green check indicates that the edit checking was successfully completed, and no errors or warnings were detected.

![]() A status code of red x indicates that the edit checks have either not yet been run or one or more errors or warnings.

A status code of red x indicates that the edit checks have either not yet been run or one or more errors or warnings.

- Batch Lock Status: Shows if the batch is locked for e-filing. Locked batches cannot be edited or modified. (May also be locked from the Current 8955-SSA Batches screen.)

![]() indicates the batch is unlocked and fulfillment options are disabled.

indicates the batch is unlocked and fulfillment options are disabled.

![]() indicates the batch is locked and fulfillment options are enabled.

indicates the batch is locked and fulfillment options are enabled.

- Statement Edit Check Status (optional): indicates if the participant statements are passing edit checks. (Not required for e-filing)

- Statement Lock Status (optional): indicates if the participant statements have been locked. Locking statements will disable editing on the plan level. (Not required for e-filing)

Batch Reports

Provide the option to download .csv files of batch details. Each report includes the Name of the Report, Filing Year, Batch Name, Batch ID as well as specific information as outlined below:- Plans in Batch: provides EIN, Plan Number, Company Name, Plan Name and Plan IDs for all plans within the specific batch. Note: The PlanIDs are a user defined field found on the Edit Plan screen. This column will be blank if not applicable.

- Participants in Batch: provides the Plan Name, Plan Sponsor Name, as participant data for the plans in the batch.

Printing

The listing of the print options will vary if Cover letters are included.- Print 8955-SSA's: Prints all Form 8955-SSAs in the batch to a single file.

- Print 8955-SSA's- Masked SSN: Prints all 8955-SSA forms in the batch with a water mark and masks all but the last 4 digits of the SSNs.

- Download 8955-SSA's to Zip: Downloads all Form 8955-SSAs that are in the batch to a zip file containing individual PDF files by plan.

- Download 8955-SSA's to Zip-Masked SSN: Downloads all Form 8955-SSAs in the batch to a zip file containing individual PDF files by plan. The files will include a water mark and masks all but the last 4 digits of the SSNs.

- Print Cover Letters: Print all cover letters per plan to a single file as either .rtf or .pdf format.

- Print Statements: Print all Participant Statements per plan to a single file as either .rtf or .pdf format.

- SSN Masking: Options open a new window to set masking preferences. Once preferences are set, selecting the Print Statements link will provide the Participant statements with all but the last 4 numbers masked.

- Download Statements to Zip : Downloads all Participant Statements in the batch to a zip file containing individual PDF files by plan.

- SSN Masking: Options open a new window to set masking preferences. Once preferences are set, selecting the Download Statements link will provide the Participant statements with all but the last 4 numbers masked

Fulfillment

Fulfillment options are unavailable until the batch edit checks have been run and the batch has been locked.- FIRE E-File: this option sends the batch to ftwilliam.com for e-filing fulfillment (additional fee applies). Once submitted returns are processed through an automated system. We cannot make any changes toe the forms once submitted.

- Selecting the link will redirect users to the agreement and authorization screen which users will need to review and select the submit button for the batches to be submitted.

- This feature uses ftwilliam.com’s TCC so customers do not need to register for their own.

Note: Accounts are not billed immediately when using this feature. The Billing Contact for the account will receive a paper invoice from CCH Inc. around the first business week of the following month after generation

Download FIRE Files

- This feature allows users to download a .TXT file to file outside of the software with the IRS FIRE site.

- To utilize this feature the account must obtain a TCC Code specifically for the Form 8955-SSA by completing an online IR Application.

- Once obtained, the Master Admin user for the ftwilliam.com account may go to the "Admin Menu" and click on "Edit Company Profile."

- Towards the bottom of this screen, there are fields to enter the 8955-SSA TCC Code, Accounts Company's Contact, EIN, and State. Make sure to click "Update" at the bottom of the screen.

- After the batch is locked the ZIP file link will be enabled. This link will download a ZIP file (or TXT file if only one plan is present) containing one file per Form 8955-SSA prepared and placed in your batch. Note: Users will have to upload each file within the ZIP file separately through the IRS FIRE site; unlike batch uploading as for 1099s.

E-Filing Form 8955-SSA

Key Differences from Form 5500

- The 8955-SSA does not require the 5500 to be locked or ready to file.

- Unlike the 5500, you do not need to lock the filing for the user to sign.

- DOL credentials are not required for the 8955-SSA.

Requirements Before E-Filing

Form Status

- All 8955-SSA forms in the batch must show “OK” for edit checks.

Portal User Permissions

- In the Edit Portal User screen, ensure “Allow 8955-SSA e-file” is set to Yes.

Granting Permissions

- Go to Work with Portal Users and Signers.

- Confirm Allow 8955-SSA e-file is marked Yes for the client.

Client E-Filing Process

Once permissions are set and the form status is OK, the client can e-file by:

- Logging into the portal.

- Selecting E-File 8955-SSA.

- Completing these steps:

- Click Print 8955-SSA.

- Print and review the paper copy.

- Click E-File 8955-SSA to submit to the IRS.

After the portal user has clicked on "E-File 8955-SSA," he/she will be directed to the main, portal "Welcome" screen and see the following message displayed in yellow:

What Happens After E-Filing Form 8955-SSA

From the ftwilliam.com User Perspective

- When the portal user clicks “E-File 8955-SSA”, the system creates a batch containing the plan.

- This batch appears on the “8955-SSA Batches – [YEAR]” screen with the status:

- Locked

- Pending

- These statuses indicate the batch has been sent to ftwilliam.com for fulfillment.

Billing Information

- Cost per Filing: $7.95 for each 8955-SSA e-filed by a portal user.

- No Batch Fee: These filings are not subject to the $16.07 batch fee.

- Fee Update: The previous $7.46 fee increased to $7.95 on 10/01/2025.

If you chose to print and mail the Form 8955-SSA plan by plan and later discover an error, then you would go back to the draft Form 8955-SSA, check the box for Part I, Item B. Make any updates necessary and file with the IRS. Or, if you wish to use the fulfillment service for the newly amended plan, then go to 'Batches/Fulfillment' to create a new batch, making sure to check the box "Amended batch?*". When you are brought to the select plan screen, you will see a listing of all plans that have the amended box checked on the 8955-SSA and that are not a part of another batch.

If you chose to use our fulfillment service and later discover an error, then you will have to create a new batch. While creating the new batch, make sure to check the box "Amended batch?*". When you are brought to the select plan screen, you will see a listing of all plans that have been fulfilled. Once you have selected the plan(s) you are amending, you will be able to go to the specific plan to make changes on the draft Form 8955-SSA. Part I, Item B will automatically be checked for you.

If you chose to have a portal user E-File via the portal and later discover an error, then you will have to go back to the plan to click on the draft Form 8955-SSA to click on "Amend 8955". By clicking on the button, the form will become editable, and the Amend box will be auto-checked. When the Form 8955-SSA has an OK status, the plan can be E-Filed again via the portal.

If you chose to download the ZIP file and later discover an error, then you will have to unlock your batch and remove the specific plan you need to amend. Then, go to the plan and check the box for Part I, Item B. Make any updates necessary and go back to the 'Batches/Fulfillment' to create a new batch, making sure to check the box "Amended batch?*". When you are brought to the select plan screen, you will see a listing of all plans that have the amended box checked on the 8955-SSA and that are not a part of another batch. Once the plans have been selected, lock your batch and download the ZIP file.

Each plan will have a default letter set up that was drafted by ftwilliam.com, which is located in the "Admin Menu" by clicking on "SAR/AFN/8955 - SSA Defaults." To modify the client letter, you have two options:

Single Plan:

For a single plan, you would go the "Form 5500 - Plan Year" screen and access the "Client Letter" in the "Form 8955 - SSA" box. It is located below the draft Form 8955 - SSA. The system will automatically save any changes you make.

Global:

To set up a global default of your own, you would go to the "Admin Menu" and click on "SAR/AFN/8955 - SSA Defaults." Make any changes necessary within the "8955 - SSA Defaults" box. The system will automatically save any changes you make. This will be the default client letter for batch printing. If you have already generated the Client Letter within a company/plan, then make changes to the "SAR/AFN/8955 - SSA Defaults" screen, the changes will not update the already-generated Client Letter.

Batch:

To set up a batch default of your own, you would go the "Form 5500 - Plan Year" screen and click on "Batches/Fulfillment" within the "Form 8955-SSA" box (or select "5500" from the "Batches" drop-down list on the "Select Company" screen). Next, click on your batch name and select "Cover Letter." From here you can choose to have "None," "Company Default," "Plan Specific" or "Batch Specific." If you choose the "Batch Specific" option, you are able to make any changes necessary on the same screen. Be sure to click "Update." This will be the default client letter for batch printing.

If you find that you need to prepare a prior year SSA, whether as an original or to amend, you will notice that the process is similar to the prior year 5500 filings.

Select your company and your plan so that you are on the "Edit/Print Menu" screen.

Select the plan year you want to prepare the prior 8955-SSA within the "Print Menu" box and click "Go." Note: For the form years 2002 - 2008, if you do not have 5500 data, you may have to click "Continue" before you can proceed.

You will have to click on "Convert To EFAST2" before you see the "Form 8955-SSA" box displayed on the right-hand side of the screen, even though you are not submitting the Form 8955-SSA to the DOL.

You will be able to prepare a batch and submit for fulfillment, or you can download the .txt file if you plan to e-file on your own 8955-SSAs. (TCC Code required).

Note. SSN Masking is a Global feature that only Master and/or Designated Admin users will be able to access.

Users may print a copy of the client letter with the Form 8955-SSA with the SSNs masked by default by clicking on 'Print Client 8955-SSA - Masked SSN'. This copy will contain a watermark at the top of all pages stating, "Client copy: do not file with IRS". Otherwise, users may continue to print the client letter with the Form 8955-SSA without masking the SSNs by clicking on 'Print Client Letter w/8955-SSA's'.

Users that wish to mask the SSNs from the copy that is published to the portal, or to mask the SSNs on the participant statements should click on 'SSN Masking' (see image above). To mask the SSNs in the portal, update 'Enable Participant Statement SSN Masking:' to Yes and be sure to click 'Update'. To mask the SSNs on the participant statements, update 'Enable Portal SSN Masking:' to Yes and be sure to click 'Update'. Portal Users that have View/Print and/or E-File 8955-SSA permissions with the Masked SSNs enabled for the Form 8955-SSA will receive a copy that resembles the Form 8955-SSA that the user generates by clicking on 'Print Client 8955-SSA - Masked SSN'. Note. SSN Masking is a Global feature that only Master and/or Designated Admin users will be able to access.

Single Plan:

Once you have the Form 8955-SSA completed, specifically page 2s, then you will be able to update participant addresses below the "Statement Data" portion of the "Form 8955-SSA" box. You will want to click on "Edit Check All" to run the edit checks for the statements. The "SSN Masking" option is only available to master/designated admins and is a global feature. By clicking on "Print All," you will generate a copy of the statements in a .pdf format. By clicking on "[rtf]," you will generate a copy of the statements in Word.

Batch Upload:

First, you would have page one of the Form 8955-SSA added, whether it was added manually; single plan upload; or via batch upload.

Next, you would create a batch and place those plans you wish to batch upload into that batch. Click on "Upload Participants" so that you may download the "Starter File (.csv)" file. You may not use the "8955Sample.csv" file that you used for each individual plan; the "Starter File (.csv)" contains plan specific data to help determine which participants belong to which plan. Once you have the starter .csv file updated, you are then able to do your batch import.

Do not click on "Add Form 8955 - SSA." First, within the "8955 - SSA" box, click on the "Upload" link. You will be directed to the "8955 - SSA Upload Menu" screen where you would click on "Page 1 CSV Upload (Page 1 Only)." Now you are on the "8955 - SSA Page 1 Upload" screen. Next, save the sample .csv file to your hard drive. Once you have your data entered and saved to the .csv file, browse for the saved file and click "Submit." Note: You may only upload one plan at a time using this spreadsheet (ftwilliam.com only looks at the first row containing data).

Do not click on "Add Form 8955 - SSA." First, within the "8955 - SSA" box, click on the "Upload" link. You will be directed to the "8955 - SSA Upload Menu" screen where you would click on "Page 1 CSV Upload (Page 1 Only)." Now you are on the "8955 - SSA Page 1 Upload" screen. Next, save the sample .csv file to your hard drive. Once you have your data entered and saved to the .csv file, browse for the saved file and click "Submit." Note: You may only upload one plan at a time using this spreadsheet (ftwilliam.com only looks at the first row containing data). Before you are able to upload participant data (Page 2), you would either have to manually click on "Add Form 8955 - SSA" or follow the steps above for the

Before you are able to upload participant data (Page 2), you would either have to manually click on "Add Form 8955 - SSA" or follow the steps above for the  The column headers for the .csv file must remain in the file that you upload and there is also a schema file that you may download, which provides you with details on how to format the .csv file. Note: You are able to upload participant addresses for the participant statements at the same time you upload the participant data. If you do not wish to use ftwilliam.com's statements, then you do not need to complete these columns.

The column headers for the .csv file must remain in the file that you upload and there is also a schema file that you may download, which provides you with details on how to format the .csv file. Note: You are able to upload participant addresses for the participant statements at the same time you upload the participant data. If you do not wish to use ftwilliam.com's statements, then you do not need to complete these columns.