- Scrub task parameters – The override parameters should reset each year to 'No' and this is generally what you want for ongoing processing after the conversion year. There are times when you may want to override calculations in years after conversion and these overrides can continue to be used, as needed. You will have to set them each year for an override to be in effect.

- Run the Scrub task – Click the Run icon

for the Scrub task, which will turn green when completed (only the first Scrub for a BOY valuation).

for the Scrub task, which will turn green when completed (only the first Scrub for a BOY valuation). - Eligibility Status report

- EOY valuation - check this report for accuracy before proceeding by clicking any of the icons in Word, pdf, or excel format.

- BOY valuation - There is no Eligibility Status report since the majority of processing occurred at the end of the previous year. You can check that prior year-end report. The only thing missing from that will be participants with a plan entry date equal to the current BOY valuation date.

- Run Benefits & Liabilities (B&L) task – Review and update parameters

- For cash balance plans only, complete

- (1) 'Current Year Actual Interest Credit Rate' (in 2nd B&L for BOY valuation)

- (2) Group definitions - click 'Groups' link and fill in the definitions (in 2nd B&L for BOY valuation)

- (3) 'Future Interest Crediting Rate Assumption for Valuation' (in 1st B&L for BOY valuation)

- Run the task by clicking the

icon, which will turn green when completed successfully (only the first Scrub for a BOY valuation).

icon, which will turn green when completed successfully (only the first Scrub for a BOY valuation).

- For cash balance plans only, complete

- Check 'Valuation Results' report - From the B&L task, check the Valuation Results report

- Ongoing years (including first year of startup plans) - Check for reasonableness (note that for startup plans with no prior service credits or account balances on the effective date, Funding Target = $0).

- Replication Year only - compare liabilities to prior system's results, with the goal to get IRC 430 Funding Target & Target Normal Cost within 2% of prior system values for automatic IRS approval for a funding method change due to a new valuation system.

Replication Year troubleshooting - If the prior valuation system did not use monthly discounting, differences (sometimes significant) can occur. ftwilliam has been granted a special class ruling by the IRS for discrepancies caused by a change to a monthly method. The ftw system uses attained ages to the month for all PV calculations. Please contact Support for further assistance.

- Confirm use of the conversion process outlined in the Steps above based on a Conversion Year prior to the Replication Year and that service-to-date amounts were entered.

- Ensure compensation history was uploaded so that 415 limits are correct.

- Verify the correct plan definition for Actuarial Equivalence in the General Information section of Plan Specifications.

- Verify IRC 430 segment rates in Assumption Specifications match the prior valuation.

- Verify the correct probability for lump sum distributions in Assumption Specifications.

- Verify account balances and/or accrued benefits at BOY and EOY match prior valuation.

- Verify Each participant’s assumed commencement date matches the previous system.

- For a cash balance plan, in the Benefits & Liabilities task verify:

- Principal credits are defined in the Groups matrix.

- The correct interest crediting rates for current year Interest Credits and the projected rate for funding purposes are both entered.

- For fractional accrual plans formulas, check that projected service at NRD matches the prior valuation. These can be overridden if necessary.

- Plan Costs task

- Replication year – Do not run the Plan Costs task – You only need to replicate liabilities and not the entire set of valuation results; however, we recommend entering credit balance overrides as follows:

- Open the Plan Costs task parameters and scroll to find the Transactions link at the bottom of the Assets and Credit Balances section.

- Click the Transactions link and click the + button in the top-right corner.

- Select the COB - Beg bal (override) and/or PFB - Beg bal (override) to enter those amounts as of the first day of the Replication Year.

- Enter the amount and click the Add & Close button.

- These values will carry to the following year and assist when populating the Schedule SB.

- Replication year – Do not run the Plan Costs task – You only need to replicate liabilities and not the entire set of valuation results; however, we recommend entering credit balance overrides as follows:

- Ongoing plan years and first year startup plans (parameters and data entry before running the Plan Costs task)

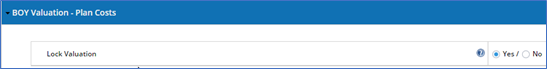

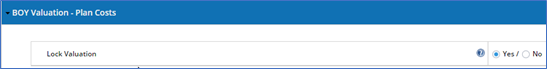

- Lock Valuation (for BOY valuations only) – After running the Scrub and B&L tasks using beginning of year data, lock the valuation liabilities from being impacted by potential future data entries/uploads or plan changes that could occur during or at the end of the year. This also locks the valuation assumptions from being changed.

- Overrides in general - Many results can be overridden by setting the override to Yes and entering the desired result. The greyed-out boxes contain calculated values from running the Plan Costs task. If you did not run a valuation in the ftw system in the previous year, there are several prior year values that you will want to override even before running the task (see further details by section below).

- Interest Rates section – If you did not run a valuation in the ftw system in the previous year, override IRC 430 prior effective rate and Prior year actual trust rate of return; otherwise, those values will automatically populate.

- Assets and Credit Balances section

- Averaged assets - If you are using an asset averaging method, enter Averaged Assets without applying the 90% - 110% MVA limitation.

- Prior year contribution adjustments - If you did not run a valuation in the ftw system in the previous year, override any relevant prior year contribution values (alternatively, you can enter prior year contributions into Transactions and the values should not need to be overridden)

- Assets and Credit Balances ('Transactions' link) – Click this link and add relevant new transactions for the year, including:

- market value of assets

- credit balance transactions

- distributions for expenses & benefit payments

- employer contributions*

- Amortization Bases – Make the appropriate selections for the application of ARPA and standing prefunding balance election. Using the 'Prior Bases' link, add existing shortfall and waiver amortizations in the first year running the ftw valuation. After that, new and existing bases will manage themselves.

- Plan Costs section – If you did not run a valuation in the ftw system in the previous year, override Prior Year FTAP and Prior Year Minimum Contribution. These will be used in various current year calculations. You can also determine the final minimum contribution due at any date you enter by running the Plan Costs task when changing the date.

- Lock Valuation (for BOY valuations only) – After running the Scrub and B&L tasks using beginning of year data, lock the valuation liabilities from being impacted by potential future data entries/uploads or plan changes that could occur during or at the end of the year. This also locks the valuation assumptions from being changed.

- Run Plan Costs task (to produce interim or final valuation, Schedule SB, and PBGC results)

- Click the

icon, which will turn green when completed successfully.

icon, which will turn green when completed successfully. - Plan Cost Results report - This is the valuation output in a csv file format that can be used to produce a custom valuation report. It also contains Schedule SB and PBGC output at the bottom.

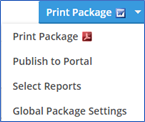

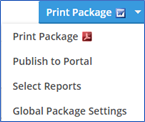

- Valuation Report pages – These formatted pages can be viewed and used independently, or to collate into a report package containing any available pages. You can also define data grids to create participant reports containing any system data.* Use the 'Select reports' option from this dropdown list to define the report, cover letter and other options.

* For participant reports - Go to the Grid Manager and add grids below the Primary Grid. They will become available to select in the report package selection list. Be aware that formatting and spacing are limited with this option, so choose and define grids with that in mind, and adjust as needed.

* For participant reports - Go to the Grid Manager and add grids below the Primary Grid. They will become available to select in the report package selection list. Be aware that formatting and spacing are limited with this option, so choose and define grids with that in mind, and adjust as needed. - Schedule SB (for ftw 5500 module subscribers)

- Populate Form - After running the Plan Costs task, go to the 5500 module and add or open your Schedule SB. Click the button on the form, 'Populate from DB Compliance' next to Part I | Basic Information.

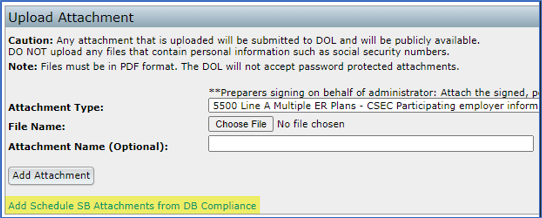

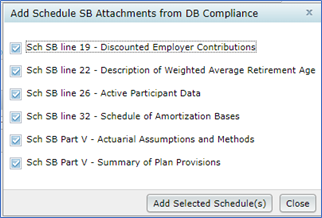

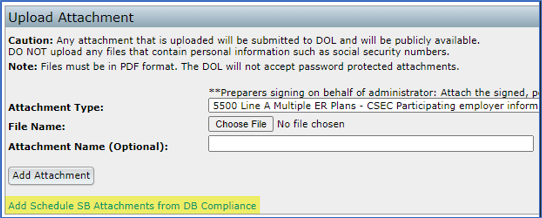

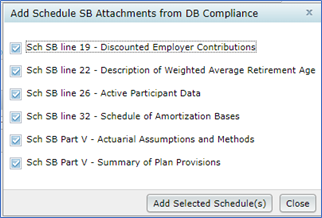

- Attachments - Add the prepared Schedule SB attachments from the Plan Costs task by clicking the blue colored text at the bottom of the following screen to select which attachments to include. Additional attachments can be added via the "Attachment Type" drop-down list.

- Click the

-

-

-

-

- 2025 Instructions for Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Instructions for Form 1099-MISC Miscellaneous Information (Rev. April 2025)

- Instructions for Form 1099-NEC Nonemployee Compensation (Rev. April 2025)

- Instructions for Form 1099-DIV Dividends and Distributions (Rev 01/2024)

- 2025 Instructions for Form 5498 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Instructions for Form 1099-INT Interest Income and Original Issue Discount (Rev. January 2024)

- 2025 Instructions for Form 1099-SA Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

- 2025 Instructions for Form 5498-SA HSA, Archer MSA, or Medicare Advantage MSA Information

- 2025 Instructions for Form 945 Annual Return of Withheld Federal Income Tax

- Instructions for Form 945-A (Rev. December 2025)

- Instructions for Form 945-X Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund (Rev. February 2025)

- 2025 Instructions for Form 945-V Payment Voucher

- Payer Data Instructions

- 2025 Form 1096 Instructions

- 2025 General Instructions for Certain Information Returns (Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G)

-

-

-

- Add Forms and Schedules

- Adding Summary Annual Report or Annual Funding Notice

- Enter Information on a Form 5500 schedule

- Consulting Official DOL Instructions

- Edit Checks

- Print All FINAL Schedules (Print Options)

- Upload and Download Center

- Deleting a Form 5500 Schedule

- Deleting an Attachment

- Inviting Portal Users to the Portal to Edit, Review and/or Upload Attachments

- Work with Signers/Portal Users

-

- Global Email Settings

- Email/Server Settings

- Portal Email Default Templates

- Portal Branding

- Portal Correspondence

- Go to 5500 Forms.

- Work with Signers/Portal Users

- 5500 > [Year] Screen

- Batch/Workflow

- Bring forward (prior year) data to (current year) for all plans

- Bring forward (prior year) signers to (current year) for all plans

- 5500 Workflow Grid; Batch Invite 5500/SF; Admin Summary Status

- Batch SAR and Batch Annual Funding Notice

- How To Complete Batch Local Sign

- Batch Lock 5500

-

- Completing an 8955-SSA

- Uploading Data to 8955 - SSA - Single Plan

- Uploading Data to 8955-SSA - Batch (for multiple plans)

- How to Create and Submit an 8955-SSA Batch

- 8955-SSA Batch Features

- How to Set Up and Allow for E-Filing of Form 8955-SSA by a Portal User

- Printing

- Fulfillment

- Portal E-File

- Download FIRE Files

- How to Set Up the Client Letter for Form 8955-SSA

- How to Use the Most Current Form 8955-SSA for Prior Years

- How to Mask SSNs on the Form 8955-SSA and Participant Statements

- Participant Statements

-

-

-

- 2024 Instructions for Form 5500

- 2024 Instructions for Form 5500-SF

- 2024 Instructions for Form 5500-EZ

- 2024 Instructions for Schedule A

- 2024 Instructions for Schedule C

- 2024 Instructions for Schedule D

- 2024 Instructions for Schedule DCG

- 2024 Instructions for Schedule G

- 2024 Instructions for Schedule H

- 2024 Instructions for Schedule I

- 2024 Instructions for Schedule MB

- 2024 Instructions for Schedule MEP

- 2024 Instructions for Schedule R

- 2024 Instructions for Schedule SB

- 2024 Summary Annual Report (SAR) Instructions

- 2024 Annual Funding Notice (AFN) Instructions

- AFN 2/2/2015 Final Rule Sec. 2520.101-5

-

-

-

- 2025 Instructions for Form 5500

- 2025 Instructions for Form 5500-SF

- 2025 Instructions for Form 5500-EZ

- 2025 Instructions for Schedule A

- 2025 Instructions for Schedule C

- 2025 Instructions for Schedule D

- 2025 Instructions for Schedule DCG

- 2025 Instructions for Schedule G

- 2025 Instructions for Schedule H

- 2025 Instructions for Schedule I

- 2025 Instructions for Schedule MB

- 2025 Instructions for Schedule MEP

- 2025 Instructions for Schedule R

- 2025 Instructions for Schedule SB

- Form 5558 Instructions

- 2025 Annual Funding Notice (AFN) Instructions

- 2025 Summary Annual Report (SAR) Instructions

-

-

-

-

-

-

-

-

- FTW Step 2: Establish the Conversion Year & Date

- FTW Step 3: Populate Plan Specifications in the Conversion Year

- FTW Step 4: Verify the Primary Grid in the Conversion Year

- FTW Step 5: Conversion Data for the Conversion Year

- FTW Step 6: Additional Conversion Data & Compensation History

- FTW Step 7: Run Scrub for Conversion Year

-

-

-

-

-

-

- 10.1. Use of the system for the first testing year

- 10.2. Use of ftwilliam.com Compliance system after the first year the plan is on the system

- 10.3. Eligibility History

- 10.4. Recalculate Initial Eligibility

- 10.5. Plan Aggregation

- 10.6. Aggregation of non-ftw plan with ftw plans

- 10.7. Disaggregation

- 10.8. HCE Determinations

- 10.9. Top Heavy

- 10.10. Compensation - Including Calculations for Self Employed Individuals

- 10.11. Overrides

- 10.12. Excluding a Class of Employees

- 10.13. Vesting

- 10.14. Age Weighted Allocations

- 10.15. JH Rate of Return

- 10.16. Davis Bacon

-

-

-

-

- Setting up Global Email Settings

- Setting Up Global Email Settings for Divisions

- How to Test the Global Email Settings for 'Specify a Server'

- How to Test the Global Email Settings for 'Preparer's Email Program'

- What SMTP Server Error Messages Mean

- How to Edit or Clone Default Email Templates and Reminders

-

- How to Send Documents to the Portal That Were Prepared in ftwilliam.com

- How to Publish a Document to the Portal for E-Signature That Does Not Originate in the FTW Software

- Description of the Client's E-signing Experience

- Sending and Receiving Direct Messages

- Saving Copies of Sent or Received Messages and Communications

-

- How to Access the Census Batch Dashboard

- Census Batch Dashboard Navigation

- How to Roll Forward Compliance Users

- How to Post a Batch Census Worksheet

- Enforcing .CSV Format for Census File Uploads

- Access to Edit the Census Worksheet within the Portal

- Edit Census Worksheet Grid

- Census Validation

- How to Push the Census from Upload to Final

- How to Upload a Batch Annual Questionnaire to the Portal (Compliance User)

-

- How Do I Access the Portal?

- How Do I Log into the Portal?

- How Do I Reset My Password?

- How Do I Change My Password?

- How Do I Change My Challenge Questions?

- How Do I Change My Name, Email or Demographics?

- How Do I Find Help on the Portal?

- How Do I View the 5500 / SAR / AFN for My Plan?

- How Do I Sign the 5500?

- How Do I Sign the 5500 Using a Prior Year User ID and PIN?

- How Do I Check the Status of the 5500?

- How Do I Complete the 5500?

- How Do I Add Attachments to the 5500?

- How Do I View a Message I Received?

- How Do I Send a Message?

- How Do I View a Document?

- How Do I Sign a Document?

- How Do I See Who Signed a Document?

- How Do I Download the Annual Questionnaire?

- How Do I Upload the Annual Questionnaire?

- How Do I Download the Census Worksheet?

- How Do I Upload the Census Worksheet?

- How Do I Complete the Online Annual Questionnaire?

- How Do I Download the Online Annual Questionnaire?

- How Do I Mark a Task as Complete?

- Home

- DB Compliance User Guide

- Detailed Step-by-Step Process

- REPLICATION YEAR & ONGOING YEARS (Steps 8 - 12)

© 2007-2025 CCH INCORPORATED. ALL RIGHTS RESERVED.

for the Scrub task, which will turn green when completed (only the first Scrub for a BOY valuation).

for the Scrub task, which will turn green when completed (only the first Scrub for a BOY valuation). icon, which will turn green when completed successfully (only the first Scrub for a BOY valuation).

icon, which will turn green when completed successfully (only the first Scrub for a BOY valuation).

icon, which will turn green when completed successfully.

icon, which will turn green when completed successfully. * For participant reports - Go to the Grid Manager and add grids below the Primary Grid. They will become available to select in the report package selection list. Be aware that formatting and spacing are limited with this option, so choose and define grids with that in mind, and adjust as needed.

* For participant reports - Go to the Grid Manager and add grids below the Primary Grid. They will become available to select in the report package selection list. Be aware that formatting and spacing are limited with this option, so choose and define grids with that in mind, and adjust as needed.