Correcting Payees in a Locked Batch (FTW Fulfillment Originals)

If the original records were processed through FTW Fulfillment, follow these steps to prepare a correction:

-

Access the FTW System

- Select the appropriate Company/Plan.

- Click 1099 to choose the Form Type and Year, then click OK.

-

Navigate to the 1099 Module

- In the Edit Payees box, use the drop-down list to select the payee that needs correction.

-

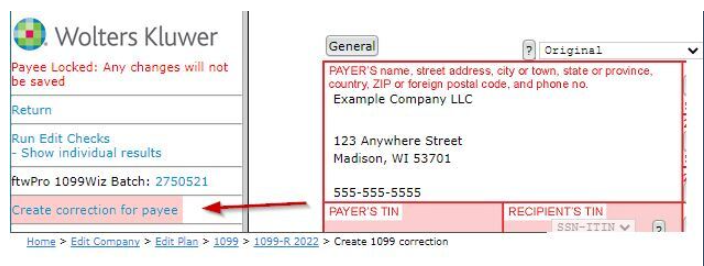

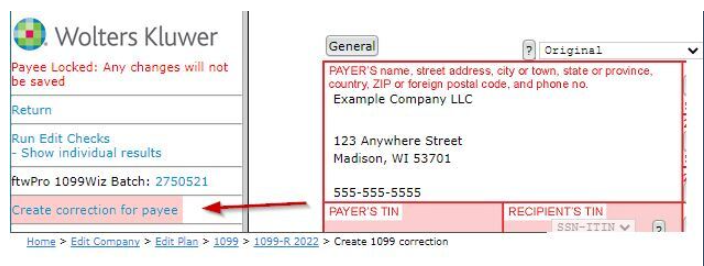

Create a Correction

- On the left-hand side of the pane, click Create Correction for Payee.

- On the left-hand side of the pane, click Create Correction for Payee.

-

Select Correction Type

- Under Please select correction type, choose Error Type 1 or Error Type 2.

- Click Create Corrective Record to finalize.

- Enter Corrected Data

- A new 1099 record will be created.

- Enter the correct information for the payee.

- Go to ftwPro 1099Wiz.

- When naming your batch, check the box in the upper right-hand corner labeled “Corrective batch?”.

- Only payees marked as corrections will be available for selection.

Please Note: Only one correction type may be added to a batch. If both Type 1 and Type 2 corrections need to be submitted, each correction type will need to be added to separate Corrective Batches.

Users will have to run the edit checks for the corrective batch before users can lock the batch and submit for fulfillment.

If correction types 1 and 2 are added to the same batch, the system will provide an error in place of the lock option. The correction types will need to be separated to proceed.

ftwilliam.com does not offer a corrective service for state fulfillment.

Batch Locked for Batch Printing

- Unlock the batch.

- Follow the IRS instructions for corrections.

- Note: The correction process depends on whether the payee has a Type 1 or Type 2 error.

Batch Locked to Download a .txt FIRE File

- Unlock the batch.

- Remove the payee(s) that need correction.

- Follow the IRS instructions.

- Important:

- If downloading a .txt file for FIRE, create a new corrective batch for the payee(s) needing corrections.

- For Type 2 errors, you will need two batches:

- One for the corrective record

- One for the new original record

- After creating the corrective batch, ensure you check the “Corrective batch?” box when naming the batch in ftwPro 1099Wiz.

- Only payees marked as corrections will be available for selection.

NOTE:

- Selecting “First Correction” from the drop-down list indicates a Type 1 error.

- Selecting “Second Correction” indicates a Type 2 error.

- Correction for Payer TIN

Note that if users have reported information for an incorrect Payer TIN, that the Payer TIN should be corrected via a letter to the IRS; see the IRS instructions for details. New for 2014 and current, users will be able to go back into "Edit Payer" to update any incorrect data, even if the Payer was in a locked batch.Reporting incorrect payer name and/or TIN. Top

If a payer discovers an error in reporting the payer (not recipient) name and/or TIN, write a letter containing the following information:- Name and address of the payer

- Type of error (including the incorrect payer name/TIN that was reported)

- Tax year

- Payer TIN

- Transmitter Control Code (TCC)

- If the ftw fulfillment service had been utilized, use

- "52202" for corrections during 01/05/2012 - 05/06/2013;

- "92966" for corrections during 05/07/2013 - 03/18/2014;

- "92C28" for corrections during 03/19/2014 - 03/24/2015;

- "92H42" for corrections during 03/25/2015 - 04/04/2016;

- "92H96" for corrections during 04/05/2016 - 03/22/2017;

- "92C28" for corrections during 03/23/2017 - 03/12/2018;

- "92H42" for corrections during 03/13/2018 - 03/05/2019;

- "92C28" for corrections during 03/06/2019 - 03/15/2020;

- "92H42" for corrections during 03/16/2020 - 02/10/2021;

- "92H96" for corrections during 02/11/2021 - 02/09/2022;

- "92C28" for corrections during 02/10/2022 - 02/01/2023;

- "92H42" for corrections during 02/02/2023 - 10/03/2023;

- "92H96" for corrections during 10/04/2023 - 01/29/2024;

- "92C28" for corrections during 01/30/2024 - 04/12/2024;

- "92H42" for corrections during 04/13/2024 - 1/29/2025;

- "92H96" for corrections during 01/30/2025 - 04/07/2025:

- "92C28" for corrections during 04/08/2025 - 01/29/2026;

- "92H42" for corrections during 01/30/2026 - present

- Type of return

- Number of payees

- Filing method (paper or electronic)

- Was federal income tax withheld?

Send the letter to Internal Revenue Service, Information Returns Branch, 230 Murall Drive, Mail Stop 4360, Kearneysville, WV 25430.

If a payer realizes duplicate reporting or a large percentage of incorrect information has been filed, contact the information reporting customer service site at 1-866-455-7438 for further instructions.

Note: You will also need to furnish a letter/statement to the recipient(s) with the updated payer information.