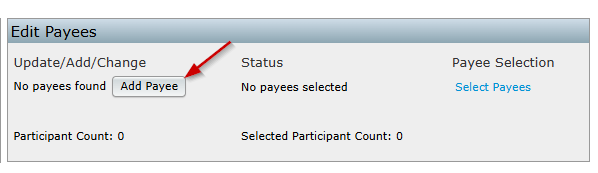

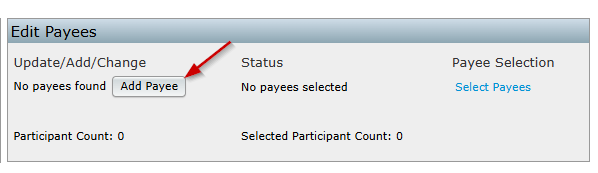

- When the user is on the "1099-X - Year" screen, the user would click on "Add Payee" button within the "Edit Payees" box.

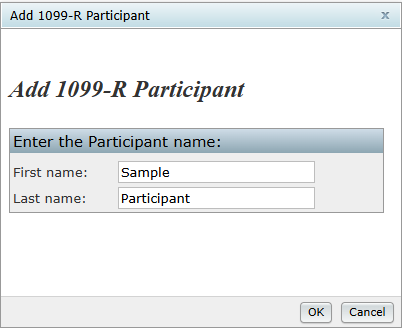

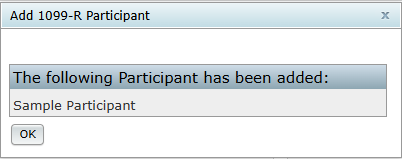

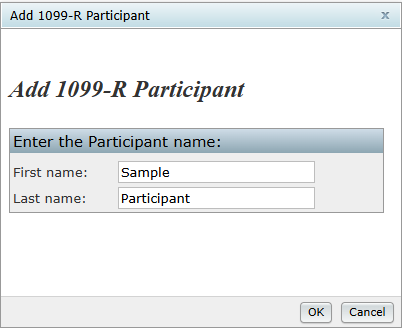

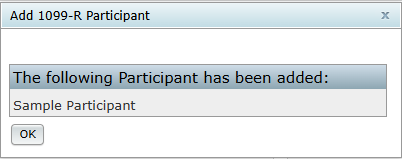

- The user will receive a prompt to enter a Payee's First Name and Last Name. Then, the user will click "Add Participant", then "Click here to return" or "1099-X Year" within the breadcrumb trail.

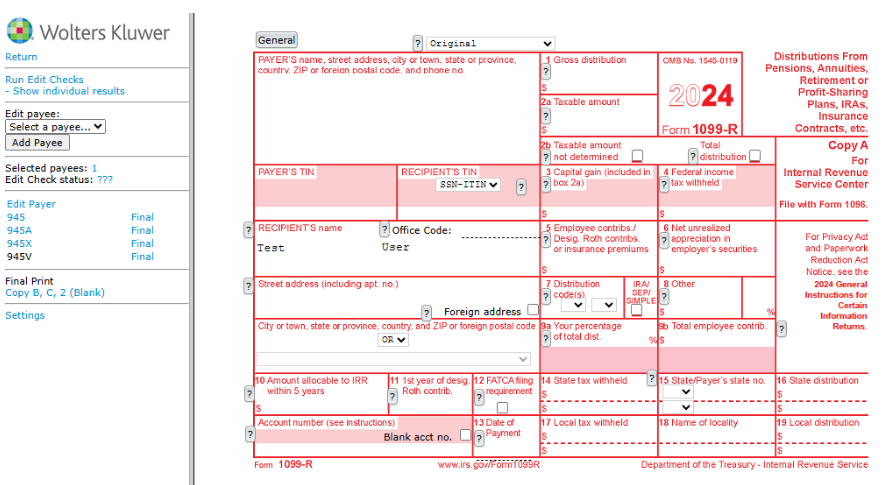

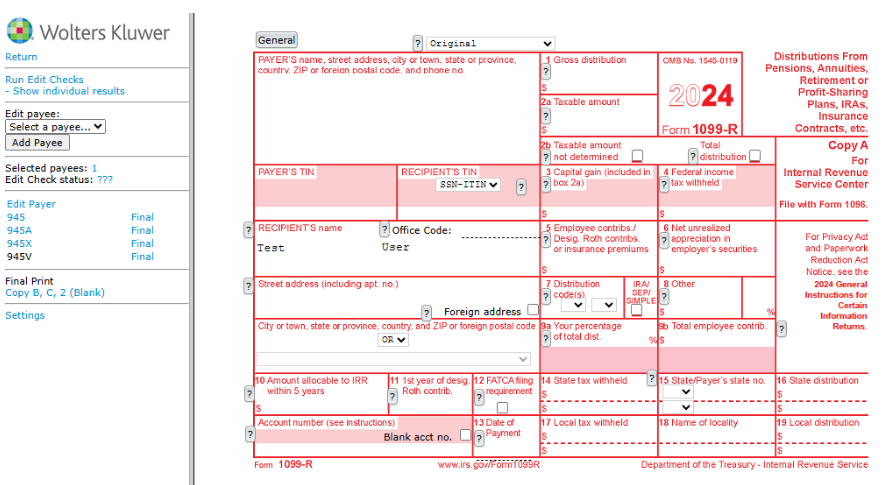

- This will direct the user to a draft Copy A for the user to complete. From this screen the user is able to run edit checks, add more Payees, go to the 945, 945-A, 945-X or even print non-Federal final copies.

Below the draft form, the user will have the option to add up to 12 distribution dates and amounts for the payee if those distributions have the same distribution code(s) as on the draft form. This is helpful for completing the Form 945. Note: If the payee received multiple distributions, but the distribution codes are not the same, the user will need to complete a 1099 record for each distribution type.

The user should run edits checks once the form is complete. See Edit checking below.

Note: The Question Marks  on the draft screen are context-sensitive help buttons that reference the IRS instructions. The user should click on them for guidance.

on the draft screen are context-sensitive help buttons that reference the IRS instructions. The user should click on them for guidance.