As of the 2024 filing year, Form 5558 can be e-filed through the EFAST2 system. This feature is not available for prior years or off-calendar plans using the 2023 Forms.

Please Note: The filing of form 5558 is a separate filing feature included in the 5500 Module. The form 5558 will not be included when filing 5500 Forms and Schedules.

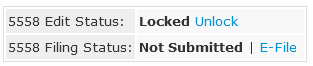

Once Form 5558 has been added to the Draft forms the 5558 Edit Status and 5558 Filing Status details will appear. *If the Form 5558 is removed, the 5558 status sections will also be removed.

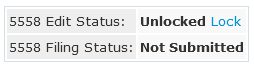

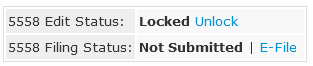

5558 Edit Status: There are two possible statuses.

- Unlocked: indicates the draft Form 5558 is editable and not ready for e-file.

- Locked: indicates the draft Form 5558 has an 'OK' edit check status, is no longer editable, and is ready to be e-filed.

- This link is disabled until the Form 5558 is passing edit checks and no critical errors are present.

- If a Form 5500/SF/EZ is added after the Form 5558, and the filing has not been submitted, users will be required to re-run edit checks and re-lock the form before submitting.

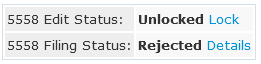

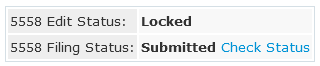

5558 Filing Status: There are three possible statuses.

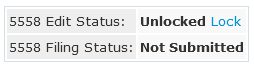

- Not Submitted

- Not Submitted: indicates the Form 5558 is unlocked and has not been e-filed.

- Not Submitted | E-File: indicated the Form 5558 is locked and enabled for E-file.

- Not Submitted: indicates the Form 5558 is unlocked and has not been e-filed.

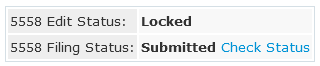

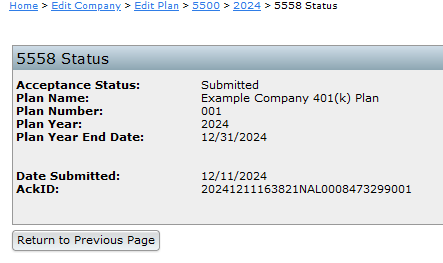

- Submitted: indicates the Form 5558 has been successfully submitted to the EFAST2 system for the IRS to review and determine eligibility of extension. Once the 5558 is submitted and accepted, it may not be amended, unlocked, or altered.

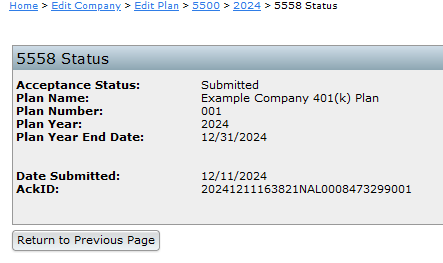

The Check Status link allows users to view the filing details including status, Date submitted and the AckID.

The Check Status link allows users to view the filing details including status, Date submitted and the AckID.

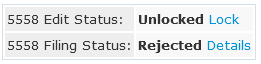

- Rejected: EFAST2 rejected the filing and the form data needs to be reviewed and updated if applicable. Selecting the 'Details' link next to the Rejected status will indicate what issues were present that caused the rejection. When a rejection occurs the form is automatically unlocked for edits to be made.

- When the Rejected Filing is relocked, the link to 'E-File' will populate once more

- When the Rejected Filing is relocked, the link to 'E-File' will populate once more

Please Note: Processed Form 5558 will not be accessible after submission on EFAST2 nor is it available by phone with EFAST2. Contact the IRS for any questions about the Form 5558.

The Check Status link allows users to view the filing details including status, Date submitted and the AckID.

The Check Status link allows users to view the filing details including status, Date submitted and the AckID.