For a large number of Payers, Payer TINs and related data can be uploaded in batch mode. Companies and plans must already be set up in the system before proceeding.

NOTE: New users without plans set up can send a list of client EINs to support@company.com. Prior year Form 5500/SF data from the Department of Labor (DOL) can be imported, regardless of the previous vendor (55AutoFill). This service will add companies and any filed 5500 plans to the account. To use this free service, email a spreadsheet with all company EINs and include the ftwilliam.com Company Code.

Steps to Download and Upload Payer TINs and Data

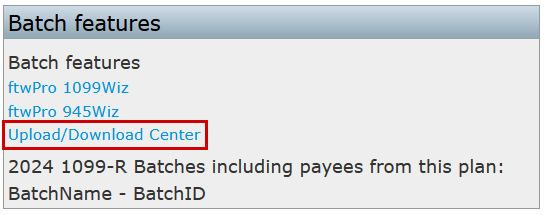

- Step 1: Access the Upload/Download Center

Go to Upload/Download Center in the Batch Features box on the 1099-X - Year screen.

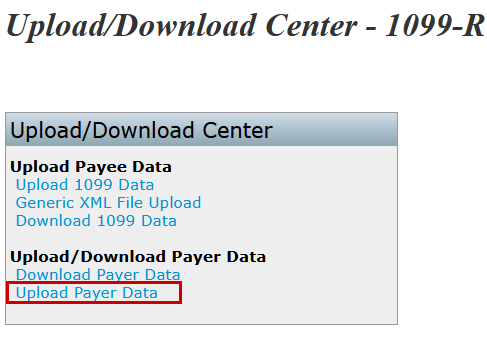

- Step 2: Download Payer Data

Click Download Payer Data under Upload/Download Payer Data and save the .csv file to the hard drive.

(Tip: Right-click and select "Save As" or "Save Target As" for a quicker save.)

- Step 3: Open and Review the Spreadsheet

Open the spreadsheet, which will list all plans set up in ftwilliam.com.- The first two columns are company and plan specific. DO NOT alter these columns.

- The remaining columns include:

- PlanName, TrustEIN, PayerNameLine1, PayerAddress, PayerCity, PayerState, PayerZip, PayerPhone, PayerEmail, etc.

- Step 4: Update the Data

Update the TrustEIN, Responsible Party, and Company Data as needed. Plans that will not require 1099/5498s can be removed, but new plans cannot be added through this upload. Missing plans must be added manually.

- Step 5: Upload the Updated File

Once updates are complete, save the file and return to the Upload/Download Center and select Upload Payer Data.

- Step 6: Select and Submit the File

On the Upload Payer Data screen, browse for the saved file.- If needed, enter the Number of Rows to Ignore Before Header Row (defaults to 0).

- Do not delete column headers.

- Step 7: Complete the Upload

Click Submit to upload the file. The total number of Payers added will be displayed.